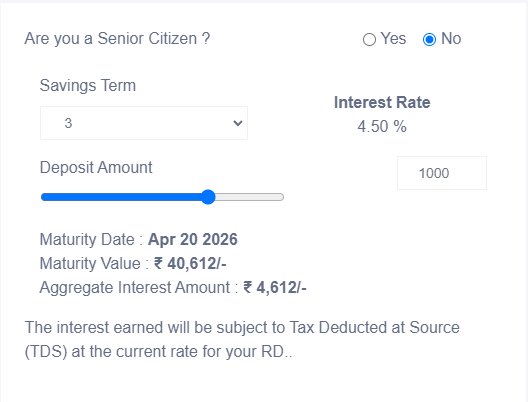

Regular Deposit (RD) of NK Bank

Through routine monthly installments, NK Bank's recurring deposit helps you increase your savings. On your recurring deposit, you can earn a greater interest rate based on the installment amount and the deposit period. Create an online recurring deposit with minimum monthly payments of Rs. 500 and a maximum that can be any multiples of that amount. On your recurring deposit, earn interest for a minimum of six months or a maximum of ten years.

Overview

Recurring Deposit Account

Setting money away to attain your goals is the first step towards securing your future. One of the numerous methods to make money from your unused money is to set up recurring deposits. We provide many RD programmes. Select the option that will best satisfy your needs and enable you to make more money for your future. When you open an account with us, you have immediate access to our programmes and advantages, including our competitive interest rates, 6-month minimum terms, and 100-pound minimum monthly payments. Continue reading

So start increasing your income while taking advantage of the many advantages of an NK Bank recurring deposit account. Lessen what you read.

Eligibility

Who can apply?

A connected Savings account is required to open an RD. No paperwork is necessary to start an RD after creating a Savings account.

Documentation Since RD is solely available to owners of Savings Accounts, no further documentation is needed.

Documents

If applicable of Memorandum of association & Article of association for Professionals, Clubs, Associations, Charitable Trusts, Religious Institutions, Government bodies established under specific Acts

Benefits

- It is convenient for business people and traders to facilitate in parking the liquid funds allowing any number of withdrawals and deposits.

- No restriction on number of transactions.

- Cheque book facility.

- Nomination facility.

- SMS alerts.

Types of Fixed Deposits

Regular Fixed Deposit:

- Save funds for a fixed tenure and enjoy a fixed rate of return.

- Flexible maturity periods ranging from 7 days to 10 years.

- Earn secured returns and build a corpus to meet your needs.

Digital Fixed Deposit :

- Open FD with full KYC without any documentation.

- Fully digital end-to-end account opening process done in 7 minutes using video KYC and basic details.

- Open your Digital FD with any bank’s Savings Account.

Tax-Saver Fixed Deposit :

- Save money for your future as well as enjoy tax benefits.

- Enjoy exemption on investment of up to Rs 1.5 lakh under Section 80C.

- Lock-in period of 5 years for the principal amount.

Fixed Deposit Plus :

- Earn higher rate of interest than regular FDs.

- Minimum investment required is Rs 2 cr.

- Choose between simple interest and compound interest.

Auto Fixed Deposit :

- Link Savings Account to FD and enjoy flexibility of Savings Account and higher returns of FD.

- Money is automatically transferred from Savings Account to FD when balance exceeds a pre-determined limit with Auto Fixed Deposit.

- Access money in FD via ATM or cheques.

Senior Citizen Fixed Deposits :

- Specifically designed for senior citizens.

- Higher interest rates compared to regular fixed deposits.

- Eligibility: Must be 60 years or older.

- Minimum investment amount required.

- Fixed period of time for the deposit.

Benefits of Fixed Deposits

- Higher interest rates: Our fixed deposit accounts offer higher interest rates than savings accounts, helping you earn more on your investments.

- Low risk: Fixed deposits are a low-risk investment option, as the interest rate is fixed and the principal amount is guaranteed.

- Flexible investment periods: You can choose the investment period that best fits your needs, ranging from 7 days to 10 years.

- Easy investment process: Opening a fixed deposit account at NK Bank is easy and hassle-free. You can visit one of our branches or apply online, and our customer service team is always available to assist you.

- Auto-renewal option: If you choose, your fixed deposit account can be set to automatically renew at maturity, ensuring that your savings continue to grow.

How to Open a Fixed Deposit Account

Opening a fixed deposit account at NK Bank is easy. You can visit one of our branches or apply online. To open an account, you will need to provide some basic personal information and proof of identity. Once your account is open, you can choose the investment period and deposit the required amount to start earning interest on your investment.

At NK Bank, we are committed to providing our customers with the best investment options to help them achieve their financial goals. Contact us today to learn more about our fixed deposit account options and how we can help you grow your savings.